In an era of fluctuating interest rates and market uncertainty, constructing a bond ladder can be a powerful strategy to secure income and manage risk. This blueprint will guide you through every stage of creating a ladder that aligns with your financial goals and adapts to changing market conditions.

Understanding Bond Ladders

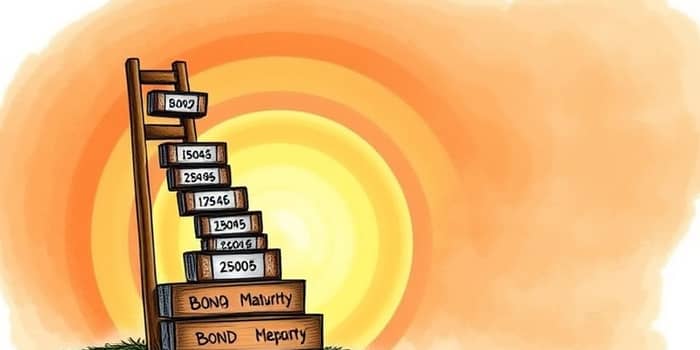

Bond ladders consist of multiple bonds or certificates of deposit purchased with staggered maturity dates. Each bond represents a rung on the ladder, maturing at regular intervals such as annually or semi-annually. As individual bonds reach maturity, the principal is returned and can be reinvested, ensuring that a portion of your capital is never tied up for an extended period. This rolling structure reduces your exposure to locking in an unfavorable interest rate while providing a steady stream of cash flow to cover expenses or reinvestment goals.

How Bond Ladders Work

The mechanics of a bond ladder are straightforward yet highly effective. You begin by selecting a series of bonds with maturity dates spaced consistently over a set horizon—say, five or ten years. You invest equal amounts in each bond, which means that every year (or every chosen interval) one bond matures. At maturity, you reinvest that principal into a new bond at the longest maturity point, thereby extending your ladder indefinitely if desired. This method ensures periodic access to both principal and interest payments, while also enabling reinvestment at prevailing market interest rates to capture rising yields and mitigate the impact of rate declines.

Building Your Ladder: Step-by-Step

- Determine total investment amount and desired ladder duration.

- Choose spacing between maturity dates (e.g., annual, semiannual).

- Select high-quality, non-callable bonds across various issuers.

- Allocate funds evenly across each rung for simplicity.

- Reinvest matured principal into new long-term bonds at maturity.

Key Benefits

- Predictable cash flows with recurring maturities.

- Reduced interest rate risk through diversifying maturities.

- Built-in liquidity for unexpected expenses or opportunities.

- Customization for specific financial milestones and goals.

Practical Considerations

- Bond selection: prioritize investment-grade, non-callable issues to avoid early redemption risks.

- Interval decisions: shorter rungs offer more frequent reinvestment flexibility but may yield slightly less than longer intervals.

- Costs and minimums: individual bond purchases often require higher minimum investments compared to mutual funds or ETFs.

- DIY vs. managed: evaluate the convenience of using broker tools, target-maturity bond ETFs, or professional portfolio management services.

Sample 5-Year Ladder Structure

The following table illustrates how a $50,000 ladder might be allocated across five annual maturities, with hypothetical yield assumptions for each year:

Variations and Specialized Ladders

Investors can tailor ladders to suit specific objectives. Goal-based ladders might align maturities with anticipated expenses such as college tuition payments, home renovations, or retirement withdrawals. Municipal bond ladders can target tax-exempt income for investors in higher tax brackets, while corporate bond ladders may offer higher yields but carry additional credit risk. Another alternative is using target-maturity bond ETFs, which deliver a laddered structure without the need for individual bond selection, simplifying rebalancing and reducing transaction costs.

Risks and Drawbacks

Despite their advantages, bond ladders are not risk-free. Callable bonds may be redeemed by the issuer before maturity, disrupting your expected cash flow pattern. Credit risk remains a concern if an issuer defaults or is downgraded, potentially impacting principal and interest payments. In periods of sharply declining interest rates, reinvested proceeds will lock in lower yields. Furthermore, selling bonds before maturity can result in capital losses if market rates have risen since purchase.

Tools and Resources

Building and maintaining a bond ladder can be streamlined with modern tools. Many brokerage platforms offer pre-built ladder solutions, interactive calculators, and recommendation engines to help you select bonds, project cash flows, and analyze yield to maturity. Free online bond ladder calculators allow you to input your desired ladder length, investment size, and interval spacing to generate a schedule of maturities and expected returns. Additionally, financial advisors can provide tailored guidance, ensuring your ladder aligns with broader portfolio objectives and risk tolerance.

Conclusion

A well-constructed bond ladder offers a compelling blend of income predictability, liquidity, and risk management. By systematically staggering maturities and reinvesting proceeds, you create a dynamic portfolio that adapts to changing interest rate environments while delivering diversification across issuers and sectors. Whether you are planning for retirement, funding education, or seeking stable portfolio enhancements, this bond ladder blueprint can serve as a versatile framework. Embrace the discipline of ladder investing and take control of your fixed-income strategy today.

References

- https://www.schwab.com/fixed-income/bond-ladders

- https://www.investopedia.com/terms/b/bondladdering.asp

- https://www.bankrate.com/investing/bond-ladder-strategy/

- https://www.fidelity.com/viewpoints/investing-ideas/bond-ladder-strategy

- https://www.invesco.com/us/en/insights/explore-the-benefits-of-laddering.html

- https://www.ssga.com/us/en/individual/resources/education/how-to-build-a-bond-ladder

- https://www.youtube.com/watch?v=A1vzppXZ30I

- https://www.youtube.com/watch?v=IjZ12Eh0SCo